Google tax closes in on internet firms

The levy, or the Google tax, is paid by those without a permanent establishment here andwhichhavean income exceeding 1 lak hay ear. DI LAS HA SETH writes

|

Note ban effect: I-T lens on 60,000 depositors

Includes those dealing in highvalue property and petrol pump owners

|

CAG Should Audit GSTN’s Work on Taxes

Leave GSTN’s internal working to its board, audit

|

Rent receipts are not enough for HRA claim

You need to have housing rent agreement and proof of money paid |

RBI tightens screws on banks to ease bad debt

The Reserve Bank of Indias (RBI’s) new — revised after 15 years — prompt corrective action (PCA) plan on loans going bad at banks could restrict normal business activity for at least 15 of the stressed lenders. And, once such a PCA plan is put in place, a bank will have to do what the RBI wishes the lender to do, putting the central bank in the driver’s seat in bad debt & .... ' |

Cleanliness Campaign Against Black Money

GLOBAL FIRST PM Narendra Modi launches Aadhaar Pay system allowing cash transfers using biometrics even without phones Prime Minister Narendra Modi launched the BHIM-Aadhaar platform, putting in place yet another keystone of a digital payment system that will help India make the shift to a less-cash economy . The biometric-based indigenous payment solution will enable real-time bank-tobank money transfers even for those .... ' |

GST: CBEC proposes eway bill for goods worth Rs 50k

Moving goods worth more than Rs 50,000 under goods and services tax(GST) will require prior online registration of the consignment and securing an eway-bill that tax officials can inspect any time during the transit tocheck tax evasion. The Central Board of Excise and Customs has issued draft rules on Electronic Way( eway) bill that require registered entities to furnish, in a prescribed format, GST Network(GSTN) website info .... ' |

No one will be deprived of benefits for lack of Aadhaar, says govt

Citizens can avail all the benefits of government schemes on alternative means of identification till the time they get their Aadhaar number, the government said on Tuesday.

“No one will be deprived of the benefits for lack of Aadhaar...

Till Aadhaar number is assigned to any individual, the benefit will continue to be given based on alternate means of identification,” according toastat .... ' |

EPFO allows withdrawals from pension a/c without Aadhaar

The Employees´ Provident Fund Organisation (EPFO) has allowed full and final withdrawal of funds by the subscribers from their pension account without providing Aadhaar number.

The members withless than 10 years of service can submit a full and final settlement claim through Form 10 C to withdraw the amount accumulated in their pension account.

However, the official said that t .... ' |

Fresh Round of Reforms Likely after State Polls

Officials say govt giving final shape to 2 labour codes, National Medical Commission & GST bills

The government may usher in a fresh round of reforms after the ongoing assembly elections in five states, when Parliament reconvenes for second half of the budget session, two senior officials said.

Some of the key bills that are being given final shape to be tabled in Parliament incl .... ' |

RBI to frame standard procedure for FDI approvals

The Reserve Bank of India (RBI) is expected to formulate standard operating procedures (SOP) for approval of foreign direct investment (FDI) proposals by ministries.

The proposal for setting up norms for FDI approvals in sensitive sectors, which are currently under government approval of the FDI policy, was discussed atarecent interministerial meeting.

According to sources, several options came up .... ' |

Startup Biggies Join Hands to Seek Changes in GST Law

The bigwigs of ecommerce, including Amazon India Head Amit Agarwal, Flipkart Cofounder Sachin Bansal and Snapdeal Cofounder Kunal Bahl joined hands to seek modifications in the draft version of the GST (goods and services tax) law. Ecommerce companies are worried about the tax collection at source (TCS) provision in the GST.

The proposed GST model makes these companies responsible for the collection of tax .... ' |

Excessive cash boosts parallel economy, says finance minister

Defending the the demonetisation move and listing out several measures undertaken by the NDA government to fight corruption and black money circulation, finance minister Arun Jaitley said the usage of cash only boosts parallel economy and thus it must be curbed. |

Affordable homes now under infra roof

Status Will Attract Large Investors |

Jaitley says July 1 target for GST rollout, but some states still not confident

Finance Minister Arun Jaitley chairing the ninth GST Council Meeting, at Vigyan Bhawan in New Delhi on Monday. (PTI) |

Undeclared assets over Rs 50 lakh on CBDT radar

Undeclared assets over Rs 50 lakh on CBDT radar 5 Lakh people to get SMSes & email today seeking clarification; can reply on portal

|

Union Budget 2017 - Key Highlights

Jaitley divided his budget proposal into 10 distinct themes: Farmers; rural population; energizing youth; poor and underprivileged; infrastructure; financial sector; digital economy; public service; prudent fiscal management; and tax administration. OPENING REMARKS: •Our government was elected amidst huge expectations; the underlying theme was good governance: .... ' |

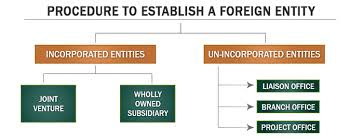

Note on Wholly Owned Subsidary Indian company of Foreign Company

This article is intended for those companies or startups that have registered their companies outside India and want to operate in India as part of a foreign company. We advise incorporating a company i.e. wholly owned company in India as one of the modes of operating a business in India. A company can be registered as private limited or public limited. A private limited company is a closely held company and enjoys the privileges given .... ' |

Tax cash withdrawals above Rs 50,000: PanelJust days ahead of the Union Budget, a high-powered panel headed by Andhra Pradesh Chief Minister N Chandrababu Naidu on Tuesday recommended imposing tax on cash transactions of at least Rs 50,000 through banks to discourage the excessive use of cash and promote digital payments. “To curb use of cash for large transactions, the ministry of finance should consider levy of banking cash transaction tax (BCTT) on transactions of Rs 50,000 and above,” the panel, constituted by Prime Minister N .... ' |

.jpg)